Raising the bar to manage R&D and ROI

Semiconductor companies are hustling to grow revenues, stay on the razor’s edge of technology and remain one step ahead of their customers’ needs. All this is going on while the industry is undergoing wrenching change.

The end of 2009 finds the chip business at a crossroads. It has been more than 60 years since the invention of the transistor. The business-process innovations we have exploited to become ever more flexible and more profitable have essentially run their course.

The biggest of these processes is the chip manufacturing model. Today, virtually all semiconductor companies are fabless, and therefore the differentiation that they once had by virtue of controlling their own fabs and their entire production strategies, has significantly declined or, in some cases, disappeared completely. This is part and parcel of a profound structural change taking place across the industry.

Meanwhile, competition has been increasing continuously. Too many suppliers are chasing the market, with the result that margins and expenses—especially R&D expenses—have come under enormous pressure.

With chip makers losing a fundamental element of differentiation against a backdrop of unrelenting margin pressure and competition, it is clear that a new set of rules will soon define the business—rules favoring chip companies that can boast superior product-development efficiencies and capabilities.

Source:

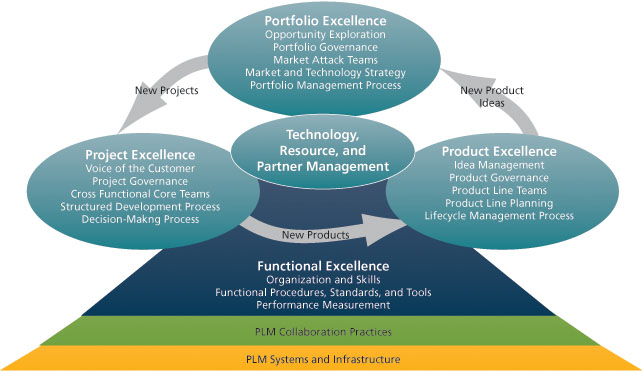

FIGURE 1 PRTM integrated framework of product development capabilities

Running the numbers

Let’s look at just how enormous the pressure is. Let’s say the investment necessary to build a system-on-chip (SoC) is $50M, a common figure these days. Companies generally target at least a 10X return on such an investment, so in this case, that $50M investment needs to yield at least $500M in revenue. Let’s assume that the company captures a third of the market. That means the company needs to target a sector that has $1.5B in total potential revenue to realize its ROI goal. There are not that many markets of this size.

Such financial goals inevitably mean there will be fewer chip startups. Those that are startups require $40M to $100M in funding and six to eight years just to break even. And for companies that jump that hurdle, the last mile is the most sobering. The M&A price for semiconductor startups has been steadily declining. In 2007, it was $160M; in 2008, it was $95M; and during the first half of 2009, the average was $65M, according to Lip-Bu Tan, chairman of Walden International, and now CEO of Cadence Design Systems.

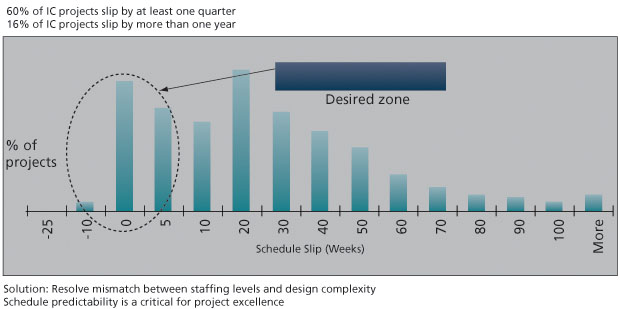

Source: PRTM/Numetrics

FIGURE 2 Schedule slips in the semiconductor industry

A different perspective

A grim future? Not necessarily. The semiconductor industry has done an excellent job of creating specialized sectors with laser-focused competencies—such as foundries—that underpin a highly efficient and optimized design chain. Companies have looked outward to help themselves differentiate, whether through IP, software, manufacturing or distribution. But with so much specialization available to so many, how do companies differentiate today? By looking inward.

Today, best-in-class companies differentiate not only through their product concepts but also through their

product-development processes. They understand that missing a schedule means lost revenue opportunity and disruption across the portfolio of products chugging through the company’s R&D pipeline. In markets where one day’s delay means more than $100,000 in lost potential revenue, productivity is taking on a new and urgent meaning.

These are some of the drivers behind the business at Numetrics and at PRTM, our partner. We understand the keys to new-product success are management skills, business processes and tools and data that foster fact-based decision making.

PRTM, a leading operational strategy consulting firm for technology companies, has developed PACE (short for ‘Product and Cycle-time Excellence’), a well-established product innovation framework that is already used successfully by a number of semiconductor companies. It has become the backbone for R&D management practices in many of these companies.

In the PACE framework, a portfolio of ‘excellence’ practices is used to manage new product ideas. Out of this portfolio come new projects that require project management best practices. Other fundamental concepts offered within PACE are based on best practices in partner management, functionality excellence and product lifecycle management (PLM).

The PACE methodology has yielded direct business benefits; as companies improve their R&D maturity, the business sees measurable results. While PACE practices are an essential foundation, success requires additional product development capabilities that can be found in five best practices to boost productivity and ensure schedules are met.

1. Optimize your global R&D footprint

Coordinating global teams has proven to be a daunting task, but it is a critical requirement for successful semiconductor product development. Leveraging a global R&D resource footprint requires the active management of:

- business requirements;

- R&D performance;

- site data; and

- decision-making reviews.

2. Use leading indicators for better decision making

Leading indicators such as budget variance, program risk, schedule variance and test coverage identify downstream issues, giving R&D managers timely information to make decisions.

3. Extend the enterprise

Establishing deep partnerships not only takes advantage of companies’ specializations, it extends the enterprise and distinguishes R&D leaders. Recognize that there are different kinds of partnerships, two of which are key: external technology insourcing and the external technology database.

- Insourcing is licensing or purchasing technology from an external organization, an arm’s-length transaction.

- The external technology database is a collaboration with an external organization—a joint venture or co-development—where technology flows from an established relationship. It is much closer than an arm’s-length transaction. This allows companies to target not only their current market but pursue licensing in the partner’s market and spin off businesses for new markets.

4. Fact-based project planning

Part of the reason so many semiconductor projects miss a deadline is that staffing levels are not aligned with the level of complexity that the design team needs to undertake. Fact-based planning provides the team with data for decision making—ensuring that projects are staffed properly to meet the demands of the design’s complexity. Estimates of design complexity, project-staffing requirements and development cycle-time are generated using empirically calibrated models. This is at the heart of what Numetrics offers. Fact-based planning:

- eases the traditional tension between groups within the enterprise that struggle to communicate in different languages by guiding discussions and strategy with facts and data;

- enables predictable revenue streams because it yields accurate schedule estimates, therefore there are no surprise shortfalls in revenue or margins;

- leads to predictable schedules, is crucial in an era when time-to-market is more important than ever, and companies cannot afford to miss the market upturn; and

- does not replace bottom-up detail planning but complements it.

5. See the pipeline clearly; manage it centrally

This best practice—and the tool behind it—rolls up all project plans to generate a picture that shows the total resources they consume. With this bird’s-eye view, engineering managers can observe where there are shortfalls and over-subscriptions role-by-role, month-by-month. This becomes an essential tool for managing the pipeline.

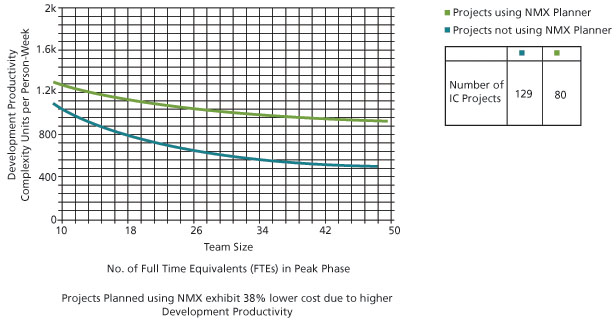

Source: Numetrics

FIGURE 3 Development cost/productivity: impact of Numetrics

Conclusion

Many factors boost productivity in product-development organizations, such as improved tools, flows, methodologies and design technologies. The real name of the game, though, is to leverage the human factor. How do you get the most out of your people?

You leverage the human factor by giving people better tools, but also by motivating them to be extremely efficient. Engineers will tune out if they think a project schedule is unreasonable or based on false assumptions. But they will be extremely productive if they are given a highly aggressive—but achievable—schedule, one that is based in fact. In short, it takes a behavioral approach, giving engineers viable project plans.

Distilled to their essence, we think the approaches promoted by Numetrics and PRTM are powerful, production-proven mechanisms for improving productivity. Applying these methods and tools is how ‘also-rans’ become best-in-class in the ever-changing semiconductor industry.

Ronald Collett is a 25-year veteran of the semiconductor industry, where he has held positions in executive management, engineering, marketing and sales. He founded Numetrics in 2000. Find out more at www.numetrics.com.